Thursday, November 16th 2017 (WASHINGTON) – The House passed the tax reform bill on Thursday afternoon, teeing it up for a more difficult fight in the Senate when Congress returns from their Thanksgiving recess.

In the end, there were 13 House Republicans who voted against the tax plan along with every Democrat. Those numbers could still change in either direction as the bill undergoes changes in the Senate and then in conference committee.

“It might cost you people, it might get you people,” Oklahoma Republican Tom Cole commented. “But there’s no issue here that cant be ironed out and settled between us.”

WHY 13 HOUSE REPUBLICANS VOTED AGAINST THE TAX CUTS

The largest group of Republicans to vote against the House version of the Tax Cuts and Jobs Act represents high-tax states that stand to lose out from the partial repeal of the state and local tax deduction (SALT). Of the 13 Republicans who opposed the current version, nine represent New York or New Jersey and three represent California.

In a Thursday morning press conference, Staten Island Rep. Dan Donovan argued that his state and a small handful of others will be “subsidizing this tax break for the rest of the country.”

According to an analysis by the Institute on Taxation and Economic Policy, while 46 states will see a $101.5 billion in tax cuts in the first decade the plan is in place, four states, California, Maryland, New Jersey and New York will see a $16.7 billion tax increase.

Rep. John Faso from upstate New York announced his no vote, saying, “I cannot allow the people of New York and the people of my district to become collateral damage in a federal tax reform bill.”

Faso and his fellow Republicans from high-tax states are holding out in hopes that the bill will improve in the Senate and in conference committee. However, the prospects of keeping the SALT deduction don’t look good. The current Senate draft entirely repeals SALT. Moreover, the Tax Policy Center has estimated the cost of keeping the state and local tax write-offs would end up raising the cost of the tax plan by $1.3 trillion over ten years.

The only other opponent of the bill was North Carolina Rep. Walter Jones, who denounced the plan as fiscally irresponsible. “My no vote is for the next generation so they won’t be bankrupt,” Jones told reporters as he walked off the House floor.

TRUMP ‘OPTIMISTIC,’ ACKNOWLEDGES DIFFICULTIES IN THE SENATE

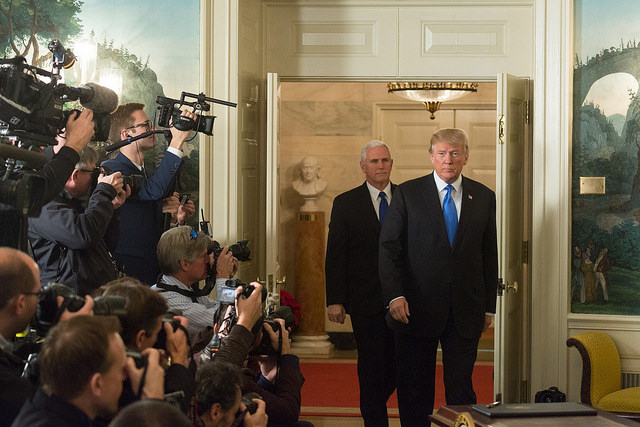

Despite the long path ahead, the mood among Republicans in the lower chamber was upbeat after clearing the first big tax reform hurdle and getting a visit from President Donald Trump earlier in the afternoon.

During the meeting, Trump congratulated the conference, its leadership and encouraged them to continue pushing ahead to get a final bill to his desk by the end of the calendar year.

“Mostly he was just optimistic that the Senate would actually pass a piece of legislation and we could go to conference,” Rep. Tom Cole said. Trump did not address the specific differences between the House and Senate versions of the tax bill or criticize individual members who were not supporting the plan. He only stressed the importance of delivering on the promise to cut taxes.

President Trump also acknowledged the difficulties ahead in the Senate, where a few conservatives have already voiced concerns over the fiscal impact of the tax cuts and their uneven distribution. Sen. Ron Johnson (R-Wis.) became the first Republican senator to oppose the bill in its current form, arguing the plan does not provide a fair tax break to America’s small businesses.

“[Donald Trump] understands we’ve taken the process as far as we can in the House,” Rep. Scott Perry (R-Penn.) told reporters after meeting with the president. “He said he saw some concern on individual senators, their statements…he’s confident they can work through it.”

SENATE REPUBLICANS TRY HORSE-TRADING, DEMOCRATS WON’T RIDE

On the other side of the Capitol, Senate tax-writers were holding their third consecutive day of hearings to mark-up their version of Tax Cuts and Jobs Act.

One of the most prevalent arguments against the $1.5 trillion tax plan is that it makes tax cuts permanent for corporations, while the majority of benefits for individuals and families expire over the course of five to eight years. One House Republican noted the sunsetting of individual tax breaks makes the plan especially hard to sell to the public.

In an effort to fix that perception, GOP tax writers in the Senate said on Thursday that they intend to make the individual tax breaks permanent.

“Our objective is to make both of them permanent,” Sen. Mike Crapo of Idaho said of both the corporate and individual tax breaks. While he sees broad support for permanent individual tax cuts, he couldn’t say how they would be paid for without adding to the federal debt.

Under Senate rules, the proposal would have to come up when the bill is on the floor and Republican Conference chairman John Thune is hopeful it will.

“All it simply takes is a vote on the floor of the Senate when this comes up in two weeks that has 60 votes,” Thune said. “If there are enough Democrats who will be with us on that, we would love to make all of the provisions on the individual side of the code permanent.”

Two top Democrats on the Finance Committee have already shot down the plan. Asked whether she would support making permanent the current plan’s individual tax breaks, Sen. Debbie Stabenow of Michigan said flatly, no. “They’d have to rewrite it,” she argued, “because it’s skewed to [benefit] millionaires and billionaires.”

Sen. Ron Wyden of Oregon also said he would not support the plan, denouncing it as another of “various scams” Republicans are trying to pull off in rewriting the tax code.

UP NEXT: TRUMP, GOP CONSIDERING ENTITLEMENT REFORM

Republicans remain confident that they will be able to get their tax plan onto President Trump’s desk by the end of the calendar year. Anticipating a policy win by the end of the year, President Trump and the party’s leadership has started talking about their next priorities: entitlement reform.

During a Tuesday night tax town hall event in Virginia, House Speaker Paul Ryan (R-Wis.) said that after getting tax cuts to grow the economy, Congress still has to tackle the debt problem. To do that, there will have to be spending cuts.

“We’ve got a lot of work to do in cutting spending,” Ryan said. “You cannot get the national debt under control, you cannot get that deficit under control if you don’t do both: grow the economy, cut spending.”

Democrats like Sen. Wyden argued that the Republican plan was “a textbook double standard with respect to economics in America.”

“The Republican deficit hawks flew away…when they saw this $1.5 trillion deficit,” Wyden said of the tax breaks. “Now they’re flying back as Paul Ryan is saying as soon as we get done with taxes we’re going to move on to entitlements.”

According to Rep. Perry, President Trump is also considering reforms to the welfare system, which he described as unfair during his Thursday closed-door session with House Republican. “He talked about us taking a look at welfare next year,” Perry noted, saying the president told them its something Congress ought to take a look at.

Earlier this week, Republicans made a controversial move to repeal the Obamacare individual mandate in an effort to free up an extra $30 billion to pay for the proposed tax cuts. They argued that the Affordable Care Act’s individual mandate was deemed a tax by the Supreme Court and therefore something that should be addressed under tax reform.

Democrats immediately denounced the plan, which they argued would raise health care costs and end insurance coverage for millions of Americans.

“It’s outrageous,” Sen. Tim Kaine (D-Va.) said after the proposal was revealed. “To end the individual mandate, 13 million fewer people would get insurance [and] they would use those savings to cut the corporate tax rate. What an outrage.”

Ohio Democrat Sherrod Brown warned that repealing the Obamacare provision will cause insurance premiums to skyrocket. He argued that the money individuals will get back in the form of tax breaks will only be paid out in the form of higher healthcare premiums.

In the coming weeks, the Senate will have to continue working to come up with the revenue to offset the heavy cost of their tax cut plan.

“It’s a challenge finding revenues,” Sen. John Thune told reporters, “but we’ll see.”

PERMANENT LINK: http://wjla.com/news/nation-world/gop-tax-plan-heads-to-the-senate