February 22, 2023

ALEXANDRIA, Va. — The value of commercial satellite imagery has become undeniable, especially in the last year. Satellite operators have revealed images to the world that would have otherwise been classified, improving transparency in conflict zones and emergencies while facilitating greater intelligence sharing among international partners.

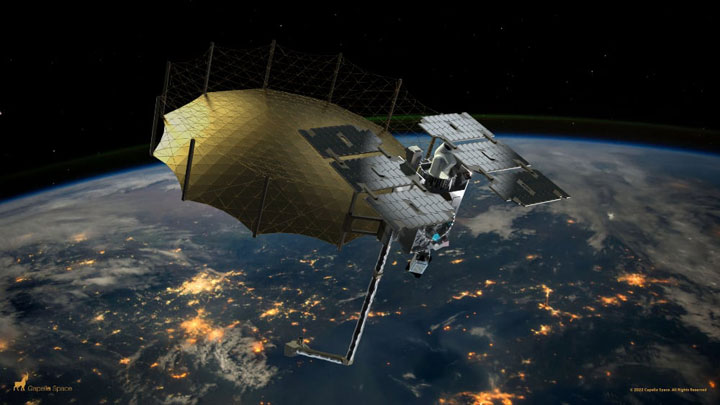

Nowhere is the value of this data clearer than the use of commercial synthetic aperture radar (SAR). In the early days of Russia’s invasion of Ukraine, Ukrainian authorities stressed the need for data on enemy troop movements at night. Electro-optical satellites could collect during the day when cloud cover and smoke were limited, only radar could deliver day or night, all-weather imagery.

“As we’ve seen in Ukraine, it’s been absolutely critical to show the world what’s happening on a daily basis,” Capella Space Founder and CEO Payam Banazadeh told Constellations. “It’s been absolutely critical for the U.S. to be able to share intelligence back to Ukraine and they’ve been able to do so by relying pretty heavily on commercial unclassified shareable data.”

That was not always the case. U.S. companies producing high-resolution radar imagery were under strict national security regulations for years. The industry started to flourish in the last 5-7 years, with American companies finally catching up with the commercial capabilities other nations have been developing for decades.

What is now a roughly $3.7 billion commercial SAR market took years of patience on the part of industry as well as an evolution in the approach to commercial remote sensing within the intelligence and national security communities and among policymakers.

Now, there are signs of accelerating usage and demand for commercial SAR, as well as tangible evidence of the benefits of shareable satellite radar imagery in a multinational operational context. When National Geospatial-Intelligence Agency (NGA) Director of Commercial and Business Operations David Gauthier announced plans to double purchases of commercial optical imagery early in the Ukraine conflict, he also announced that the agency had pushed commercial SAR capabilities into service “months earlier than planned” and at five-times the rate expected.

Civil and commercial SAR is being used in Turkey and Syria to assist with disaster recovery and assess the scale of the earthquake using change detection maps. ICEYE has begun providing near real-time SAR imagery to monitor flooding and other natural disasters. Ursa Space uses its constellation of SAR satellites to monitor oil inventories, providing transparency into the global energy market.

What Took So Long for Commercial SAR?

Over the next decade, commercial SAR will represent a $16.9 billion revenue opportunity and amount to nearly one-quarter of the total Earth observation market, according to NSR. Despite government and military demand for radar imagery, U.S. companies have only recently joined that global market.

At seven years old, Capella Space was the first American company to build and operate a synthetic aperture radar satellite. It’s Denali, launched in 2018, was the first U.S. commercial SAR satellite in orbit.

“When we started the company back in 2016, there was no commercial SAR in the U.S. It just didn’t exist,” explained Banazadeh.

…

Read the full article: https://www.kratosdefense.com/constellations/articles/the-complicated-history-of-us-commercial-sar-market-competition-and-national-security